Towards a simplified, sustainable and robust VAT system

What is VAT and why is it important?

The importance of value-added taxes (VAT) to the European economy cannot be underestimated.

VAT is a consumption tax borne by the final consumer which is charged on nearly all supplies of goods and services by businesses to both consumers and other businesses, whereby businesses are responsible for collecting the required VAT and sending it to the tax authorities. As a result, the VAT system in each EU member state has a significant influence on the daily lives of businesses that play a key role in facilitating the smooth handling of millions of transactions every day and sharing the required information with trading partners and tax authorities. It is also one of the main revenue raisers for EU member states.

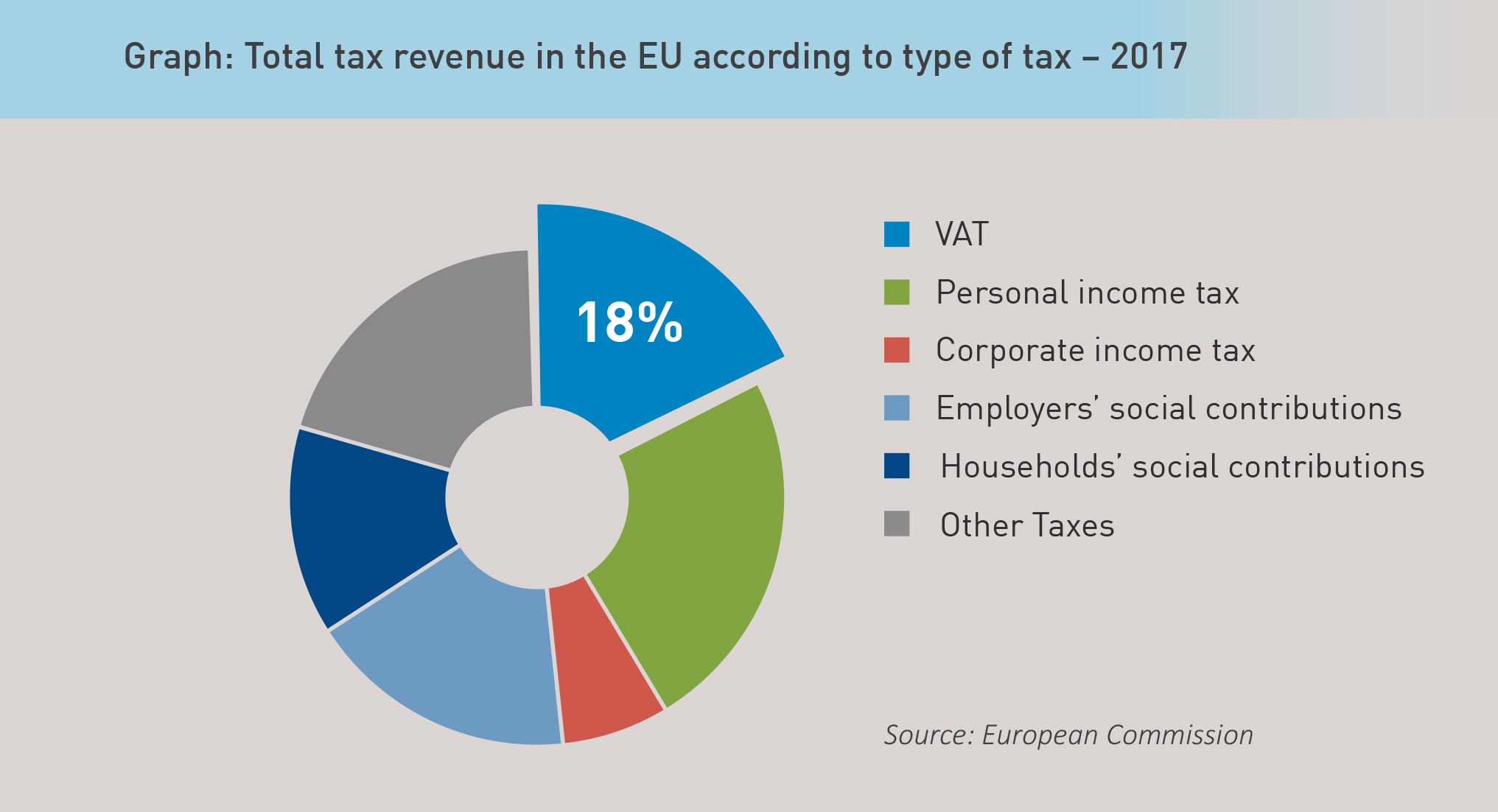

The European Commission estimates that over €1 trillion of VAT was collected in the EU in 2017 – equivalent to 7% of the EU’s total GDP, a share that has been growing for over a decade - or nearly one fifth of the EU’s total tax revenue. It goes to show that even the smallest of changes to the VAT system, at EU or member state level, can have huge repercussions on the EU’s overall economic performance and member state tax revenue.