BusinessEurope Headlines No. 2022-03

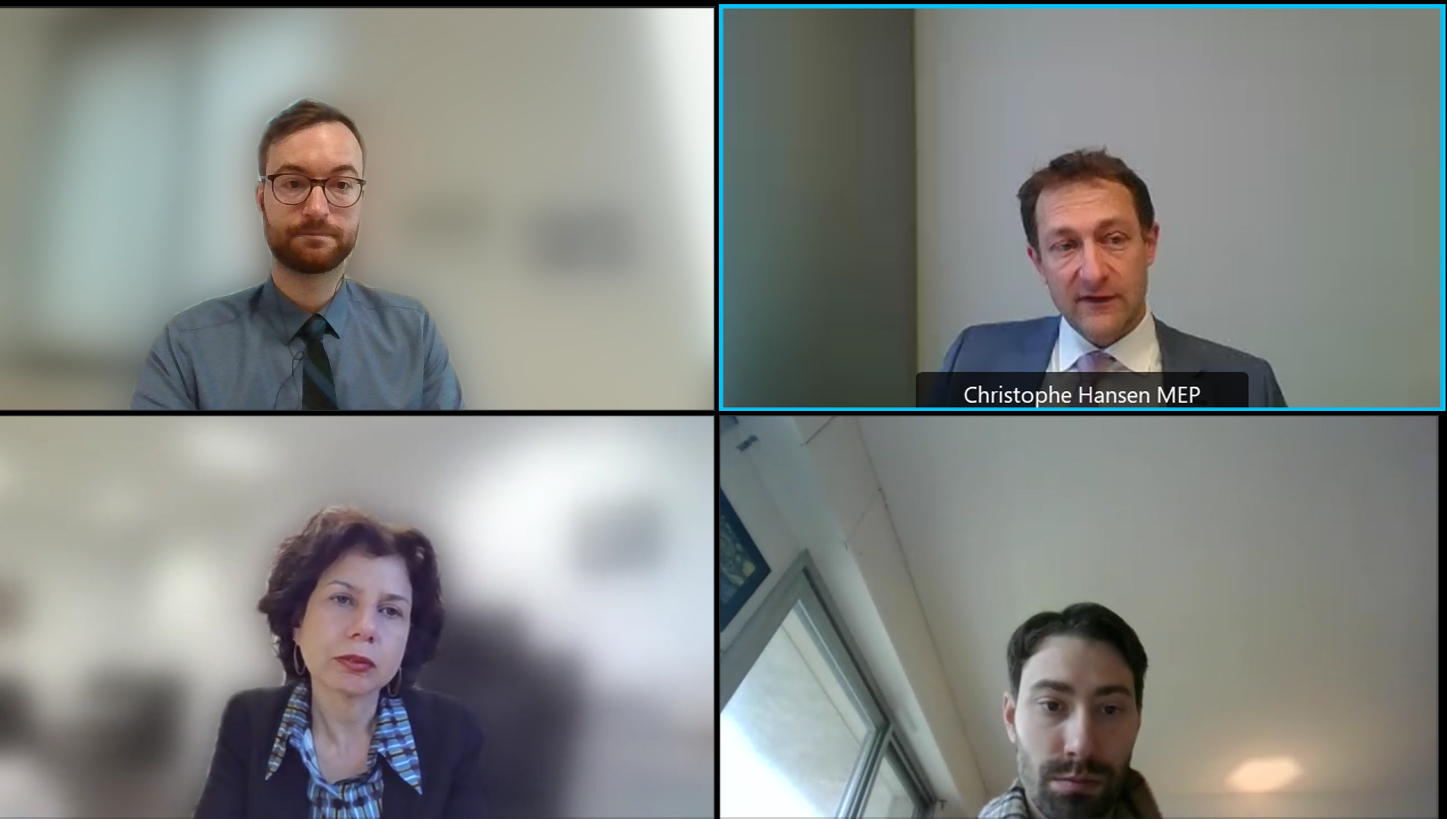

Foreign subsidies: debate with MEP Christophe Hansen

“The instrument on foreign subsidies is a key initiative for the European business community. It will fill a regulatory gap that currently exists and contribute towards a more level playing field in the European Single Market”, said Luisa Santos, BusinessEurope Deputy Director General, at a meeting of the BusinessEurope Foreign Subsidies Task Force on 2 February. At the meeting, Christophe Hansen, rapporteur for the foreign subsidies instrument at the European Parliament Committee on International Trade (INTA), presented the main elements of his draft report and gave an overview of the ongoing discussions in the European Parliament. After his presentation, he engaged in a lively discussion with BusinessEurope’s members. The legislative proposal for a foreign subsidies instrument, which the European Commission published in May 2021, is currently being discussed in the Parliament and the Council. The Parliament is expected to vote on it during its plenary in May 2022. “It is now important that we advance towards adopting a comprehensive and effective instrument that addresses market distortions while providing legal certainty to economic operators. BusinessEurope stands ready to engage actively in this process and provide the views of the European business community,” Santos added.

![]() Contact: Benedikt Wiedenhofer

Contact: Benedikt Wiedenhofer

Fit for 55: what EU business needs to reach the target

BusinessEurope Director General Markus J. Beyrer explains the changes needed in the Fit-for-55 package so that Europe’s businesses can stay competitive while we undergo a monumental change.

Future of the emissions trading system

BusinessEurope Adviser for Climate Policy, Steffen Engling, talks about the revision of the EU Emission Trading System, the ETS. Join us at our event with MEP Peter Liese on 9 February!

EU digital governance: lessons and consequences for Canada

On 27 January, the Jean Monnet Centre of Excellence hosted a webinar on the EU digital governance to discuss the lessons learned from the GDPR and its consequences for Canada. One take away was that uneven interpretation of the rules can have a discouraging effect for businesses’ growth - an observation that Canadian privacy experts will be considering going forward with the Canadian data protection discussions. “The GDPR unfortunately has insufficient proportionality element. It was and it is easier for larger companies to comply with it”, said Martynas Barysas, Internal Market Director at BusinessEurope. He explained that a business wanting to scale up and sell cross border has to do a lot of research before determining their investment. “Often there is so much uncertainty that they give up”, he added. BusinessEurope will be looking into future discussions of how digital and tech governance through regulation impacts the "classical" trade in goods and services.

On 27 January, the Jean Monnet Centre of Excellence hosted a webinar on the EU digital governance to discuss the lessons learned from the GDPR and its consequences for Canada. One take away was that uneven interpretation of the rules can have a discouraging effect for businesses’ growth - an observation that Canadian privacy experts will be considering going forward with the Canadian data protection discussions. “The GDPR unfortunately has insufficient proportionality element. It was and it is easier for larger companies to comply with it”, said Martynas Barysas, Internal Market Director at BusinessEurope. He explained that a business wanting to scale up and sell cross border has to do a lot of research before determining their investment. “Often there is so much uncertainty that they give up”, he added. BusinessEurope will be looking into future discussions of how digital and tech governance through regulation impacts the "classical" trade in goods and services.

Contact: Svetlana Stoilova

Views on civil society involvement under EU free trade agreements

“The network of EU free trade agreements (FTAs) is key for the competitiveness of European companies. It opens new markets, helps create a level-playing field, facilitates access to inputs, and improves the investment climate for European investors in partner countries”, said Benedikt Wiedenhofer, Adviser in the International Relations Department of BusinessEurope, at a hearing at the European Economic and Social Committee (EESC) on 31 January. At the hearing, different stakeholders from business, trade unions, NGOs and international organisations were invited to share their views on civil society involvement under EU FTAs and comment on the EESC draft opinion “A new framework for free trade agreements, economic partnership agreements and investment agreements that guarantees the real involvement of civil society organisations and the social partners and ensures public awareness”. Wiedenhofer pointed out that the mechanisms to involve civil society in the implementation of EU FTAs, such as domestic advisory groups, are not perfect. However, many improvements have been achieved over the past years. The review of the EU 15 points action plan on trade and sustainable development chapters in EU trade agreements is a good opportunity to take stock of the state of play. “BusinessEurope already shared some ideas within the framework of the public consultation on this issue last year and we will keep engaging in this process”, he added.

“The network of EU free trade agreements (FTAs) is key for the competitiveness of European companies. It opens new markets, helps create a level-playing field, facilitates access to inputs, and improves the investment climate for European investors in partner countries”, said Benedikt Wiedenhofer, Adviser in the International Relations Department of BusinessEurope, at a hearing at the European Economic and Social Committee (EESC) on 31 January. At the hearing, different stakeholders from business, trade unions, NGOs and international organisations were invited to share their views on civil society involvement under EU FTAs and comment on the EESC draft opinion “A new framework for free trade agreements, economic partnership agreements and investment agreements that guarantees the real involvement of civil society organisations and the social partners and ensures public awareness”. Wiedenhofer pointed out that the mechanisms to involve civil society in the implementation of EU FTAs, such as domestic advisory groups, are not perfect. However, many improvements have been achieved over the past years. The review of the EU 15 points action plan on trade and sustainable development chapters in EU trade agreements is a good opportunity to take stock of the state of play. “BusinessEurope already shared some ideas within the framework of the public consultation on this issue last year and we will keep engaging in this process”, he added.

![]() Contact: Benedikt Wiedenhofer

Contact: Benedikt Wiedenhofer

BusinessEurope position on EU minimum effective corporate tax

Following the European Commission's proposal on 22 December for the introduction of an EU minimum effective corporate tax, BusinessEurope released its position paper this week. The paper argues that the introduction of a minimum tax has the potential to bring stability and coherence to the international corporate tax system, provided that it is globally implemented in a harmonised way, in accordance with the global agreement reached at the Organisation for Economic Co-operation and Development (OECD) in October. However, we argue that a priority in the implementation of the EU directive should be the protection of European competitiveness. While the current EU proposal aligns closely with the key elements of the OECD agreement, it is essential that a “gold-plated” approach is strictly avoided, now and in the future, as it would risk putting European companies at a competitive disadvantage and cause double taxation. Similarly, the OECD agreement must not end up as an “EU only” agreement, and the paper underlines that the implementation of the OECD agreement by third countries should be followed diligently.

Following the European Commission's proposal on 22 December for the introduction of an EU minimum effective corporate tax, BusinessEurope released its position paper this week. The paper argues that the introduction of a minimum tax has the potential to bring stability and coherence to the international corporate tax system, provided that it is globally implemented in a harmonised way, in accordance with the global agreement reached at the Organisation for Economic Co-operation and Development (OECD) in October. However, we argue that a priority in the implementation of the EU directive should be the protection of European competitiveness. While the current EU proposal aligns closely with the key elements of the OECD agreement, it is essential that a “gold-plated” approach is strictly avoided, now and in the future, as it would risk putting European companies at a competitive disadvantage and cause double taxation. Similarly, the OECD agreement must not end up as an “EU only” agreement, and the paper underlines that the implementation of the OECD agreement by third countries should be followed diligently.

![]() Contact: Pieter Baert

Contact: Pieter Baert

Calendar

- 8-12 February: EU Industry Days

- 9 February: BusinessEurope event: The future of the emissions trading system and industrial competitiveness in Europe

- 10 February: European Consumer Summit

- 17-18 February: European Union - African Union summit

Not yet a subscriber? Register here.

Reminder: please have a look at our privacy policy