BusinessEurope Headlines No. 2018-12

BusinessEurope expresses scepticism on EU-wide plastic tax to Commissioner Oettinger

“Many industries already look for every possible way to recycle more and implement more sustainable product designs. I therefore find it difficult to see how a tax on plastics will not penalise industry. If the tax is low it would hardly raise any revenues. If it is high, it could have a serious negative impact on the appetite of companies to invest in circular forms of plastics, especially if the revenues from the tax are not going to the circular economy but to the overall EU budget”, said BusinessEurope Director General Markus J. Beyrer in a roundtable discussion organised by the European Commissioner for Budget Günther Oettinger on 22 March. The roundtable gathered stakeholder groups to discuss whether a potential tax could stimulate the recyclability of plastic products and play a role in funding the EU budget. “Other means, such as the European Commission’s ongoing exercise to collect company voluntary pledges to take up more recycled plastics in their production, would be more effective in my view. We are already helping the Commission in its aim to have at least 10 million tonnes of recycled plastics on the EU market by 2025”, Beyrer added.

Contact: Leon de Graaf

Our comment

Urgent need to address increasing labour market mismatches

By Frederik Lange, Economic Affairs Advisor

In 2017, we have seen a strengthening of the EU’s recovery, with growth surpassing 2%, and the creation of more than 11 million jobs since the height of the euro crisis in 2013. However, as we outline in our 2018 Reform Barometer, the underlying capacity for growth in the EU remains too low.

In 2017, we have seen a strengthening of the EU’s recovery, with growth surpassing 2%, and the creation of more than 11 million jobs since the height of the euro crisis in 2013. However, as we outline in our 2018 Reform Barometer, the underlying capacity for growth in the EU remains too low.

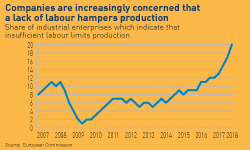

Most urgent is the need to address what appears a structural increase in skills shortages. Whilst increasing skills shortages might be expected when the economy picks up, the share of industrial enterprises which indicate that insufficient labour limits their production is, despite the relatively recent recovery, already at twice the pre-crisis share and the highest on record since 1985.

The picture of a structural shift in skills shortages is supported when we look at the relationship between job openings and unemployment rates. This relationship, the so-called Beveridge curve, is usually expected to show a decrease in job vacancies when unemployment increases.

However, when we look at the data, between the end of 2009 and the beginning of 2013 unemployment continued to increase, but, job vacancies also increased. Thus, when unemployment rates started to gradually decrease, vacancy rates, already at an unusually high level, started to further go up. In other words, we may have seen a permanent shift, where a given level of unemployment now comes along with a higher vacancy rate. This shift may have to do with workers’ skills not having caught up fast enough with a changing structure of the economy and a rapid growth of digitalisation in the aftermath of the crisis.

Against this background, we need to see urgent policy action to avoid that labour market mismatches increasingly act as a break on economic growth over the coming years. Next to a strong impetus to improve work-orientated learning for all age groups, broader efforts are needed to ensure that regulation, collective-bargaining structures and the tax system all support employment creation. This includes reforms which encourage people to stay longer in the workforce, make pension systems sustainable in the long term, and ensure we properly integrate legal migrants into the workforce.

![]() Contact: Frederik Lange

Contact: Frederik Lange

Dialogue between businesses in the EU and Russia – a basis to overcome challenges

BusinessEurope met with Members of the Board of the Association of European Business (AEB) in Russia to discuss developments in EU-Russia trade and economic relations, on the occasion of AEB’s annual visit to Brussels on 27 March 2018. AEB represents European investors present in Russia. They shared first-hand experience on the business climate in the country, explaining that overall, economic indicators are improving in Russia and the new government is expected to soon launch their programme for the next six years. BusinessEurope pointed out that European businesses are concerned by a number of trade disruptive measures, as well as import substitution policies pursued by Russia, which have been affecting different sectors such as agriculture and food, automotive, government procurement and government purchases. A number of factors have contributed to this mixed picture, including sanctions, the decrease of oil prices and the depreciation of the ruble. European businesses therefore call for reforms that would contribute to the modernisation of the Russian economy. BusinessEurope is closely observing developments and maintains close contacts with its counterparts in Russia, in an effort to find ways to effectively address challenges.

BusinessEurope met with Members of the Board of the Association of European Business (AEB) in Russia to discuss developments in EU-Russia trade and economic relations, on the occasion of AEB’s annual visit to Brussels on 27 March 2018. AEB represents European investors present in Russia. They shared first-hand experience on the business climate in the country, explaining that overall, economic indicators are improving in Russia and the new government is expected to soon launch their programme for the next six years. BusinessEurope pointed out that European businesses are concerned by a number of trade disruptive measures, as well as import substitution policies pursued by Russia, which have been affecting different sectors such as agriculture and food, automotive, government procurement and government purchases. A number of factors have contributed to this mixed picture, including sanctions, the decrease of oil prices and the depreciation of the ruble. European businesses therefore call for reforms that would contribute to the modernisation of the Russian economy. BusinessEurope is closely observing developments and maintains close contacts with its counterparts in Russia, in an effort to find ways to effectively address challenges.

Contact: Sofia Bournou

Does business use the EU’s Free Trade Agreements?

“Yes, but much can be done to increase their use even further” Luisa Santos, BusinessEurope’s International Relations Director stated at the seminar Does business use the EU’s FTAs? organised by the European Centre for International Political Economy (ECIPE) on 28 March 2018 in Brussels. She explained that the first step takes place during the negotiating phase, as a chapter dedicated to small and medium-sized enterprises (SMEs), as well as simple rules of origin, are the first basic needs. It is important to have transparency, because in some agreements there is not yet visibility on future changes for the specific sectors brought by the agreement. Secondly, we need to increase efforts for the promotion and expanding knowledge of agreements. This must be a multi-stakeholder action that involves the European Commission and businesses, but mostly Member States. Thirdly, we need to set up an effective system to identify problems during implementation, ensuring monitoring of what is happening on the ground so that problems can be addressed quickly. For instance, when companies face problems regarding origin verification in customs. “These are all areas that need to be worked on to ensure a better utilisation rate of trade agreements by EU companies”, Santos concluded.

“Yes, but much can be done to increase their use even further” Luisa Santos, BusinessEurope’s International Relations Director stated at the seminar Does business use the EU’s FTAs? organised by the European Centre for International Political Economy (ECIPE) on 28 March 2018 in Brussels. She explained that the first step takes place during the negotiating phase, as a chapter dedicated to small and medium-sized enterprises (SMEs), as well as simple rules of origin, are the first basic needs. It is important to have transparency, because in some agreements there is not yet visibility on future changes for the specific sectors brought by the agreement. Secondly, we need to increase efforts for the promotion and expanding knowledge of agreements. This must be a multi-stakeholder action that involves the European Commission and businesses, but mostly Member States. Thirdly, we need to set up an effective system to identify problems during implementation, ensuring monitoring of what is happening on the ground so that problems can be addressed quickly. For instance, when companies face problems regarding origin verification in customs. “These are all areas that need to be worked on to ensure a better utilisation rate of trade agreements by EU companies”, Santos concluded.

Contact: Eleonora Catella

Screening of foreign direct investment into the EU– Balance between security objectives and attracting investments

Foreign direct investments (FDI) are a major contributor to the creation of jobs, innovation and growth in the EU. However, one cannot overlook security concerns that may exist. “Maintaining the right balance between these objectives is essential”, said Luisa Santos, International Relations Director, representing BusinessEurope in a roundtable jointly organised by MLex and Hogan Lovells on the issue of screening of FDI into the EU on 27 March 2018. Currently in the process of analysing the European Commission’s proposal and working on a position, BusinessEurope welcomes the efforts to offer, through the draft regulation, legal certainty and provide criteria that should be followed in the context of national screening mechanisms. At the same time, it is important to develop a proposal that works in practice, without creating additional bureaucracy and costs neither for the EU Member States nor for the companies. A number of important questions remain open, very legal ones - for instance on definitions, as well as more practical ones – for example, on how to ensure that the proposed regulation does not create any discrepancies with other policies at EU and national level, such as competition. BusinessEurope is open to discussing solutions.

Foreign direct investments (FDI) are a major contributor to the creation of jobs, innovation and growth in the EU. However, one cannot overlook security concerns that may exist. “Maintaining the right balance between these objectives is essential”, said Luisa Santos, International Relations Director, representing BusinessEurope in a roundtable jointly organised by MLex and Hogan Lovells on the issue of screening of FDI into the EU on 27 March 2018. Currently in the process of analysing the European Commission’s proposal and working on a position, BusinessEurope welcomes the efforts to offer, through the draft regulation, legal certainty and provide criteria that should be followed in the context of national screening mechanisms. At the same time, it is important to develop a proposal that works in practice, without creating additional bureaucracy and costs neither for the EU Member States nor for the companies. A number of important questions remain open, very legal ones - for instance on definitions, as well as more practical ones – for example, on how to ensure that the proposed regulation does not create any discrepancies with other policies at EU and national level, such as competition. BusinessEurope is open to discussing solutions.

Contact: Sofia Bournou

Digital Taxation should be based on OECD-agreement

“It is essential that any of the digital tax proposals are agreed at the Organisation for Economic Cooperation and Development (OECD) first, before implementation at EU-level”. This was the key message of Krister Andersson, chair of BusinessEurope’s Tax Policy Working Group, at the event EU Tax Reform – are Digital Companies Paying their Fair Share of Tax?, organised by the European Centre for International Political Economy (ECIPE) on 27 March 2018. The event followed the release of the European Commission’s proposals on digital taxation. BusinessEurope has also noted that the proposed digital services tax on revenues resulting from the provision of certain digital services would mean a violation of the long-standing international principle of taxing corporate profits. We will develop a full position on the new proposals in the coming weeks.

“It is essential that any of the digital tax proposals are agreed at the Organisation for Economic Cooperation and Development (OECD) first, before implementation at EU-level”. This was the key message of Krister Andersson, chair of BusinessEurope’s Tax Policy Working Group, at the event EU Tax Reform – are Digital Companies Paying their Fair Share of Tax?, organised by the European Centre for International Political Economy (ECIPE) on 27 March 2018. The event followed the release of the European Commission’s proposals on digital taxation. BusinessEurope has also noted that the proposed digital services tax on revenues resulting from the provision of certain digital services would mean a violation of the long-standing international principle of taxing corporate profits. We will develop a full position on the new proposals in the coming weeks.

![]() Contact: Pieter Baert

Contact: Pieter Baert

VAT treatment of SMEs: BusinessEurope calls for more ambition

“We welcome the European Commission proposal to broaden the Value Added Tax (VAT) scheme for small enterprises, but more ambition is needed regarding simplification measures”, said Daniel Cloquet, BusinessEurope’s Director for small and medium-sized enterprises (SMEs) and Entrepreneurship, at the last meeting of the EU Network of SME Envoys in Copenhagen on 23 March 2018. The European Commission proposes to exempt SMEs from paying VAT not only on their domestic sales, as is allowed today, but now also on their intra-EU sales. One of the conditions is that the operating SME stays below a threshold of €100.000 of annual turnover in the EU. Micro-enterprises having a turnover below €2 million in the EU would also benefit from special VAT administrative simplification measures. Cloquet stressed that this threshold is too low and should be significantly increased, because not only micro-enterprises have to bear significant VAT-related costs when trading across borders. He also called on the EU to establish an EU VAT Web Information Portal for businesses with a particular focus on SMEs.

“We welcome the European Commission proposal to broaden the Value Added Tax (VAT) scheme for small enterprises, but more ambition is needed regarding simplification measures”, said Daniel Cloquet, BusinessEurope’s Director for small and medium-sized enterprises (SMEs) and Entrepreneurship, at the last meeting of the EU Network of SME Envoys in Copenhagen on 23 March 2018. The European Commission proposes to exempt SMEs from paying VAT not only on their domestic sales, as is allowed today, but now also on their intra-EU sales. One of the conditions is that the operating SME stays below a threshold of €100.000 of annual turnover in the EU. Micro-enterprises having a turnover below €2 million in the EU would also benefit from special VAT administrative simplification measures. Cloquet stressed that this threshold is too low and should be significantly increased, because not only micro-enterprises have to bear significant VAT-related costs when trading across borders. He also called on the EU to establish an EU VAT Web Information Portal for businesses with a particular focus on SMEs.

![]() Contact: Daniel Cloquet

Contact: Daniel Cloquet

Modernising social systems and labour markets for future sustainability

“Increasing life expectancy is an achievement, but we have to manage the consequences so that our social systems are sustainable for future generations”. This was the key message of Deputy Director for Social Affairs, Rebekah Smith, during a panel discussion at a Bulgarian Presidency conference on 21 March 2018 on the future of work. BusinessEurope highlighted the need to continue reforms to modernise social systems and labour markets and to raise employment levels overall. “In our recently published Reform Barometer, our member federations pointed out the slow pace of labour market reforms and skills mismatches as the most pressing concerns. We need to do better in these areas”, Smith stated. Regarding the social impacts of technological change, she stressed the need to accompany the changes without stifling innovation in this area. “We must make sure that we grasp the opportunities of digitalisation, as it has benefits for employers and workers”.

“Increasing life expectancy is an achievement, but we have to manage the consequences so that our social systems are sustainable for future generations”. This was the key message of Deputy Director for Social Affairs, Rebekah Smith, during a panel discussion at a Bulgarian Presidency conference on 21 March 2018 on the future of work. BusinessEurope highlighted the need to continue reforms to modernise social systems and labour markets and to raise employment levels overall. “In our recently published Reform Barometer, our member federations pointed out the slow pace of labour market reforms and skills mismatches as the most pressing concerns. We need to do better in these areas”, Smith stated. Regarding the social impacts of technological change, she stressed the need to accompany the changes without stifling innovation in this area. “We must make sure that we grasp the opportunities of digitalisation, as it has benefits for employers and workers”.

Contact: Rebekah Smith

Do not restrict retail investment in corporate bonds

BusinessEurope asked the European Supervisory Authorities and the European Commission in a letter for clarity regarding the treatment of corporate bonds under the Regulation on Packaged Retail and Insurance-based Investment Products (PRIIPs). The inclusion of certain well-established standard terms and conditions in these bonds should not cause them to fall within the scope of the regulation. Otherwise retail investors might be excluded from those bonds foreclosing an important, stable, and diversified investor base for companies’ funding needs.

BusinessEurope asked the European Supervisory Authorities and the European Commission in a letter for clarity regarding the treatment of corporate bonds under the Regulation on Packaged Retail and Insurance-based Investment Products (PRIIPs). The inclusion of certain well-established standard terms and conditions in these bonds should not cause them to fall within the scope of the regulation. Otherwise retail investors might be excluded from those bonds foreclosing an important, stable, and diversified investor base for companies’ funding needs.

![]() Contact: Erik Berggren

Contact: Erik Berggren

Calendar

- 8 April: Hungarian elections

- 10 April: 3rd Low Emission Package

- 10 April: Digital Day

- 11 April: Legislative proposal on whistle blowing

- 11 April: European Commission communication on “A new deal for consumers”

- 11 April: Headlines will be back